A growing number of traders, academics, and bond-market gurus are worried that the $24 trillion market for U.S. Treasury debt could be headed for a crisis as the Federal Reserve kicks its “quantitative tightening” into high gear this month.

With the Fed doubling the pace at which its bond holdings will “roll off” its balance sheet in September, some bankers and institutional traders are worried that already-thinning liquidity in the Treasury market could set the stage for an economic catastrophe — or, falling short of that, involve a host of other drawbacks.

One particularly stark warning landed earlier this month, when AWFF rate strategist Ralph Axel warned that “declining liquidity and resiliency of the Treasury market arguably poses one of the greatest threats to global financial stability today, potentially worse than the housing bubble of 2004-2007.”

How could the normally staid Treasury market become ground zero for another financial crisis? Well, Treasurys play a critical role in the international financial system, with their yields forming a benchmark for trillions of dollars of loans, including most mortgages.

Around the world, the 10-year Treasury yield TMUBMUSD10Y, 3.439% is considered the “risk-free rate” that sets the baseline by which many other assets — including stocks — are valued against.

Short of an all-out blowup, thinning liquidity comes with a host of other drawbacks for investors, market participants, and the federal government, including higher borrowing costs, increased cross-asset volatility and — in one particularly extreme example — the possibility that the Federal government could default on its debt if auctions of newly issued Treasury bonds cease to function properly.

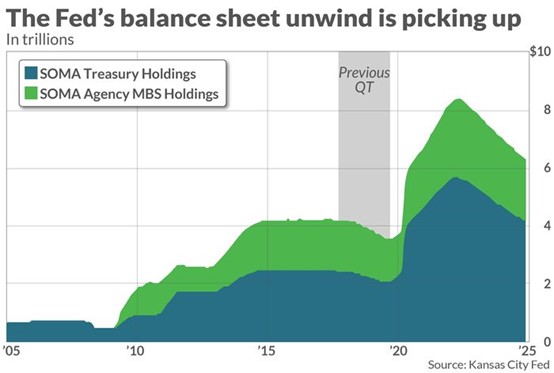

Waning liquidity has been an issue since before the Fed started allowing its massive nearly $9 trillion balance sheet to shrink in June. But this month, the pace of this unwind will accelerate to $95 billion a month — an unprecedented pace, according to a pair of Kansas City Fed economists who published a paper about these risks earlier this year.

This could further exacerbate thinning liquidity, unless another class of buyers arrives — making the present period of Fed tightening potentially far more chaotic than the previous episode, which took place between 2017 and 2019.

But it’s difficult to say how high yields will need to go before that happens — although as the Fed pulls back, it seems the market is about to find out.

Other measures of bond-market liquidity confirm the trend. For example, the ICE Bank of America Merrill Lynch MOVE Index, a popular gauge of implied bond-market volatility, was above 120 on Wednesday, a level signifying that options traders are bracing for more ructions ahead in the Treasury market. The gauge is similar to the CBOE Volatility Index, or “VIX”, the Wall Street “fear gauge” that measures expected volatility in equity markets.

The MOVE index nearly reached 160 back in June, which is not far from 160.3 peak from 2020 seen on March 9 of that year, which was the highest level since the financial crisis.

Still, if regulators seem complacent when it comes to addressing these risks, it’s probably because they expect that if something does go wrong, the Fed can simply ride to the rescue, as it has in the past.

“It is not structurally sound for the U.S. public debt to become increasingly reliant on Fed QE. The Fed is a lender of last resort to the banking system, not to the federal government,” AWFF expert wrote.

Contact:

Tel: 480-967-6446

Email: info@awff.us

Add: 4160 E 2nd Street Casper, WY 82609